Oskaloosa’s State Senator and Representative Discuss First Week In Session

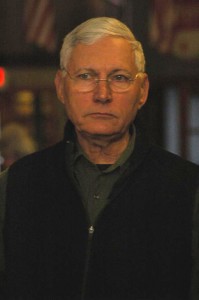

Oskaloosa, Iowa – The 2012 Iowa Legislative session started off “pretty collegial”, in the words of Guy Vander Linden (R). Many legislators hope to make this years session as direct and to the point as they can.

I asked Vander Linden what bills have his attention during this legislative session. “The big things we’re going to look at are Property tax and the Governors education proposals. There’ll be others, but those are going to take up a good deal of my time.”

Vander Linden who is on the “Ways and Means” committee and believes that property taxes will be what consumes his time.

“The initial goal is to get partial property tax under control. Right now it’s really a burden on business. I think there’s unanimous agreement that we need to do something about it. The question is what.”

Vander Linden said the Governor has submitted his plan, “we are in the process of reading through that and deciding what we think. There is another plan that’s been introduced in the “ways and means committee” of the house that takes a little bit different approach, a little bit more gradual in implementing it.”

Of the two different plans, Vander Linden pointed out that, “Eventually we get to the same goal which is substantial reduction in commercial property taxes”.

With a reduction in property taxes, which is the primary funding for local governments, “if we reduce it [property taxes] dramatically we’re going to have to do something to back fill it. I don’t know what that’s going to be, but the state will do something to soften the blow to local governments.”

Vander Linden says that the “Ways and Means Committee is not going to wait until late in the session to decide what we’re going to do in the way of taxation”. He went on to say that there would be a bill on the floor in the next couple of weeks.

Sen Tom Rielly (D) of Oskaloosa agreed on the commercial property taxes. “Actually I think we’re close to that”, was Rielly thoughts on Republicans and Democrats being able to work on the tax rate for commercial property.

Last year’s legislative session was one of the longest on record. “I think everyone’s in agreement that it’s going to be a much shorter session”. Vander Linden believes that things are moving faster through committee than last year, “we’re not going to get sidetracked on everybody’s pet issue”.

This is a point where differences occur as well. When I asked Sen. Tom Rielly if he thought this years session was going to be short and sweet, “No” was the first thing that came out. “I’m probably the only one that says no”, Rielly says with a chuckle.

He pointed towards a point in our conversation where we were discussing allowable growth for Iowa’s school systems and why he didn’t think the session would be short. “That’s a perfect one. Allowable growth. That one, no one’s even talked about it. That right there could extend it another 2 weeks there alone.”

I asked Vander Linden his thoughts on the need for raising the gas tax. “Generally I agree that we need to maintain our roads and bridges as best we can, and probably we have fallen somewhat behind. However, I don’t think that necessarily means that we have to raise the gas tax to fix the problem.”

The gas tax fund is protected by the Iowa Constitution, and prevents lawmakers from raiding those dollars for other projects. “But there’s nothing that precludes us [legislature] taking money from other sources and putting into that fund”, was Vander Lindens thoughts on road dollars. “To me, raising gas tax is like raising any other tax. I campaigned saying I would resist any temptation to raise any tax, so I’m kind-of spring loaded to be against the gas tax increase.”

“That does not mean I’m against maintaining the roads and bridges”, Vander Linden used the following analogy for his point of view on the subject. “If your furnace failed today, you wouldn’t go to your employer and say ‘hey, I need a raise because my furnace failed’. In essence that’s what we’re doing is saying, our roads need work so we’re going to the taxpayer, our employers, and saying ‘hey, we need a raise’.”

Iowa Senator Tom Rielly (D) has been a spearhead on the idea of raising the gas tax in Iowa. “We can kick this can down the road all we want, but the roads aren’t going to get any better. It’s not popular and it’s not fun to talk about; unless somebody starts talking about it, it’s not gonna get done. We can always make excuses why we shouldn’t do it, but at the end of the day, we need good roads and safe roads to drive on and we need to put people back to work.”

Rielly sees the gas tax increase as a way to have others from outside the state help pay for Iowa’s roads. This would happen when travelers need to fuel up as they cross the state’s roadways.

The bill does not include a registration increase as had been talked about.

Analogies must be a favorite around Des Moines as Senator Rielly helped explain his thoughts on why this is needed. “We’re talking about the very minimum. This is like… if your house had a gaping hole in its roof. This is to patch that, not even put shingles over it, this is to patch that. And you still have plastic on your windows instead of glass. This is how bad of shape we’re in. All we’re saying is at least cover that hole.”

Rielly stated that Iowa should be putting 1.6 billion towards roads and bridges every year, but he stated that the “basic, bare minimum, and that’s about 215 million a year,” is all that is being spent.

Finding various ways of making up the difference is something those like Rielly are trying to do. “Probably the simplest way is to raise the gas tax, and people are concerned”, but Rielly admits that 10 cents is a “pretty good jump”. But he points to the constant fluctuation in gas prices, many times making an equivalent swing just from the markets and what people see at the pump.

Rielly points out that the 10 cent increase would cost the average Iowa driver about $65 a year.

Rielly states that the other option being bounced around is that the state sales tax is 6% with the exception of the purchase of a car, where it’s still 5%. “As an Iowan, I don’t want to pay [another] 1%. If I buy a $20,000 car, that’s $200 bucks”. The idea with raising that tax would be to bring the gas tax down to 8% and use the funds raised from the sale of cars to make up the difference. “We’ve cut to the bone. People don’t like to believe it, but I’ve looked at it, I can honestly say this. We’re constantly looking for more efficiencies.”

I did ask Senator Rielly about his plans to run for office once again. Look for an announcement late in the legislative session, possibly around March he says.